|

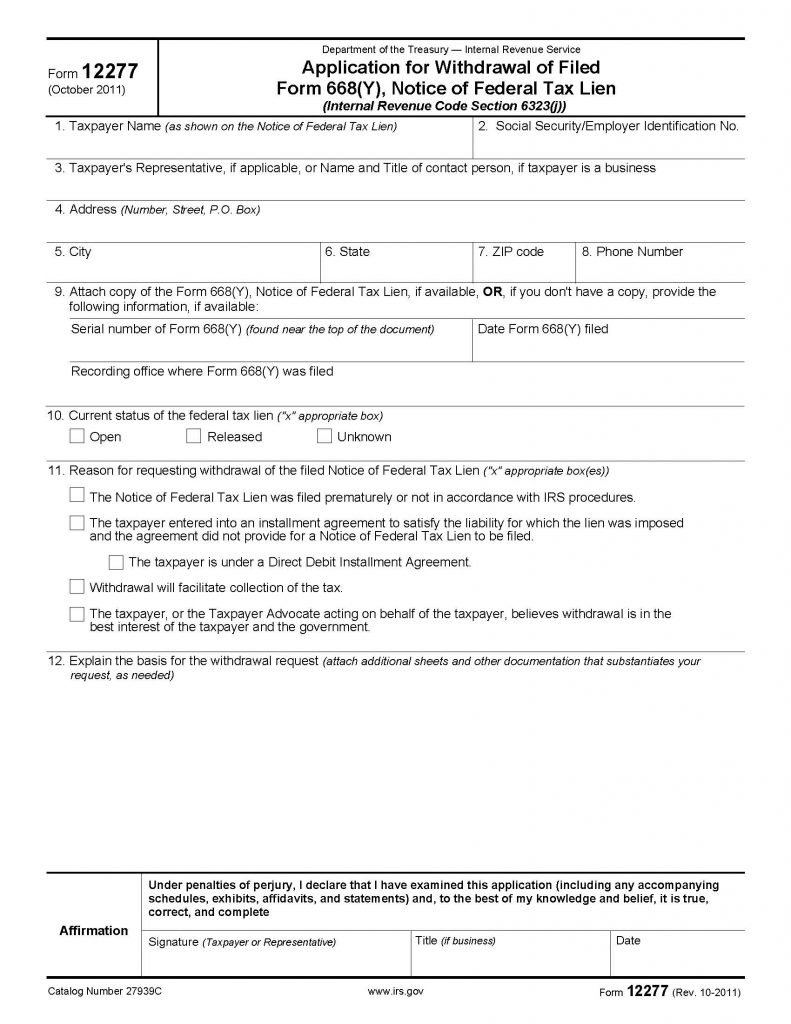

IRS Lien Release Form (Form 12277) |

The IRS lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the Internal Revenue Service (IRS), once the debt has been satisfied. There are other reasons as well, for filing this form. These reasons are listed on the form and may be selected while completing the document.

If a taxpayer should decide they are prepared to file this document with the Internal Revenue Service, be certain that copies of all supporting documentation is available to the agent who shall review the request. This will minimize the time in which a decision is made and implemented.

How to Write

Step 1 – Download in Adobe PDF (.pdf).

Step 2 – Once the download is complete – Submit the following information:

- The taxpayer’s name as it is shown on the initial tax lien notice

- The Social Security number or Employer Identification number

- Submit the name of the taxpayer’s representative or contact person

- Street address

- City, State, Zip Code

- Telephone number

- AND

- Attach a copy of the form (668Y) which is the notice of the tax lien

- If there is no copy of this information, enter the following:

- The serial number of 668(y)

- The date of the form that was filed

- Enter the recording office where 668(y) was filed

- The status (current) of the tax lien by marking the applicable box

- In section 11. – Select and check the box that would best indicate the reason for a request of withdrawal of the lien

- In the large field provided on the form, explain the taxpayer’s basis for request of the withdrawal

Step 3 – Affirmation (Signature) –

- The taxpayer or their representative must read the statement above the signature box

- If in agreement, the taxpayer or representative must then enter their signature

- Title (if any)

- Date the signature in mm/dd/yyyy format

Once the document has been completed, copies should be made for all interested parties, for record keeping purposes